Kionne Epps: How The Responsible Homegirl is Helping Break the Paycheck-to-Paycheck Cycle

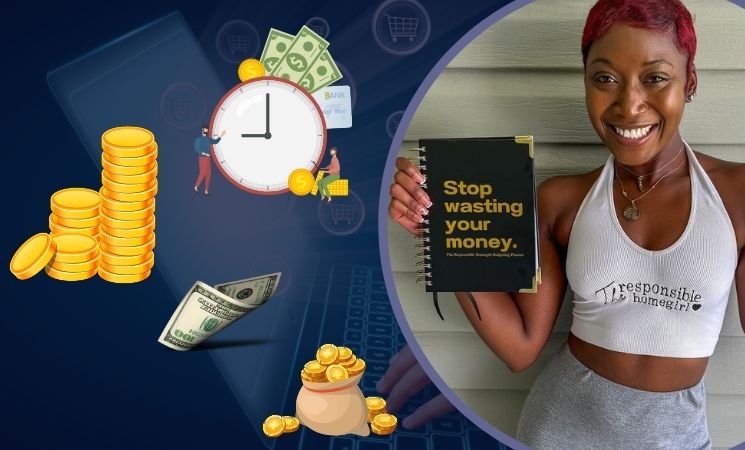

Kionne Epps, founder of The Responsible Homegirl, is a financial educator and entrepreneur. She is based in Charleston, South Carolina, where she shares financial tips to help break the paycheck-to-paycheck cycle. With an estimated net worth of $1-3.5 million, she empowers young adults with budgeting and saving strategies to build financial freedom.

Kionne Epps, also known as “The Responsible Homegirl,” isn’t just talking about money—she’s making financial wisdom accessible, especially for young women. With a down-to-earth style, she’s turning complex money topics into easy, actionable steps that anyone can follow. Her mission? To help people escape the paycheck-to-paycheck cycle and gain financial freedom.

How Kionne’s Journey Shaped Her Mission

Back in 2016, Epps was a freshman at the College of Charleston, living her best life with a generous scholarship that covered all her expenses. With refund checks of $5,000 to $7,000 per semester, she spent freely, enjoying the independence of college life. But as she moved off-campus in her senior year, things changed. Only a few months in, she realized she had no money left to pay her rent. She was facing possible eviction and was too embarrassed to ask anyone for help.

This wake-up call led her to take control of her finances. She spent hours reading books, watching videos, and listening to podcasts about money. In 2020, she launched The Responsible Homegirl to share what she had learned. Now, Epps teaches people that understanding money doesn’t have to be complicated. She uses her story to show how small, manageable steps can lead to big financial wins.

The Work of The Responsible Homegirl

Through her platform, Epps makes financial education fun and easy to understand. The Responsible Homegirl helps people of all ages learn the basics of money management—like budgeting, saving, and building credit. Epps’s goal isn’t just to help people manage their money; she wants to close the racial wealth gap by teaching financial independence to communities often left out of these conversations.

Epps emphasizes that money management isn’t just for those who already have wealth. She believes financial literacy can empower anyone to improve their life and even create generational wealth. Her goal is to help people avoid the “trial and error” approach to finances, making money lessons easy and approachable for all.

Real Talk on Financial Education

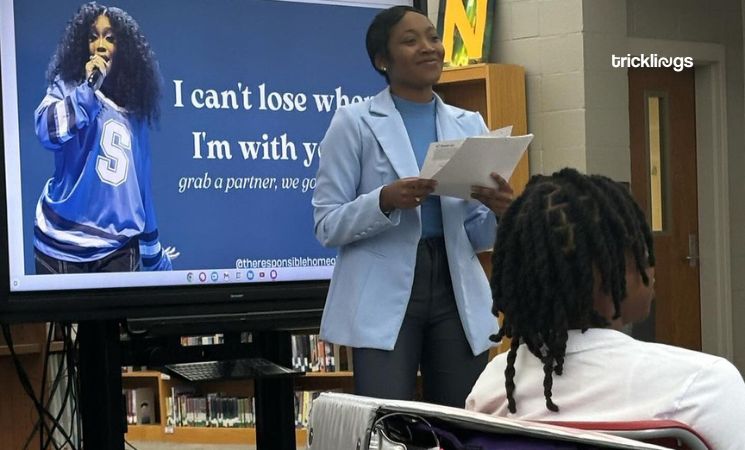

Kionne doesn’t just offer general tips; she’s known for her expert advice on tackling real-world money challenges. Recently, on InvestigateTV, she shared strategies to help viewers break the paycheck-to-paycheck cycle, encouraging them to take control of their finances with practical steps. She also uses her platform to discuss topics like budgeting, building credit, and smart saving in a way that’s relatable and fun.

In a lively conversation on FYI FLI with Hassan Thomas for FinLit Friday, she discussed more than just money basics. She and Hassan delved into action steps for building a brand, tips for cutting unnecessary expenses, and the importance of using money as a tool. They also shared budgeting techniques that aren’t overwhelming, helping young women—and anyone else following—to stick to a financial plan without feeling restricted.

Kionne’s style is down-to-earth. She’s not afraid to share her past mistakes, like spending her scholarship checks without saving. Instead of only showing the polished side, she talks openly about her financial struggles, making her content both relatable and genuine. This transparency is part of what makes her so popular; people see her as a friend who has been through it all and come out stronger.

Though her net worth is modest in comparison to household names, Kionne Epps’s influence far surpasses monetary value. Estimated at between $1 million and $3.5 million, her net worth reflects her varied income streams and entrepreneurial spirit. She continues to expand her reach by investing in real estate, adding another layer to her financial portfolio.

Tips and Inspiration on Instagram

Kionne also shares her financial wisdom on Instagram, where she engages her followers with practical tips and encouraging advice. Her posts range from budgeting hacks to managing credit wisely, and each post is packed with guidance that’s easy to follow. Her Instagram isn’t just a feed; it’s a hub of daily motivation and financial education, inspiring her community to take control of their money, one step at a time.

If you don’t have at least $1k in a savings account, watch 5 Tips to help you Save Money by Kionne💰