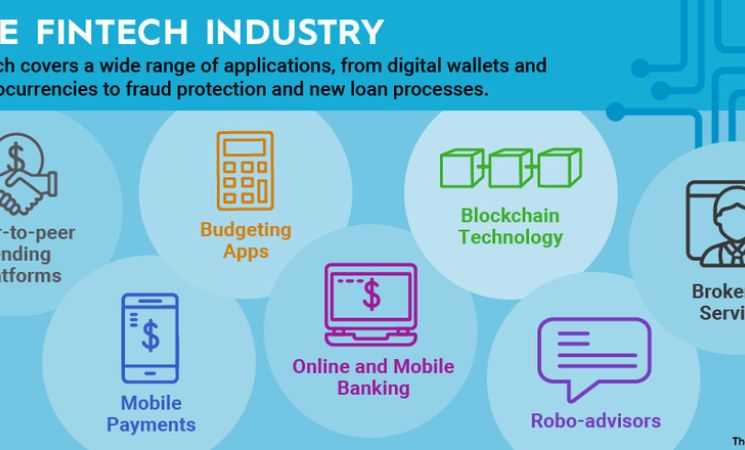

The fintech industry is booming, revolutionising how consumers interact with financial services. However, with great innovation comes equally significant risks, particularly in the realm of cybersecurity. As digital financial services expand, they face an increasing array of cyber threats that can compromise consumer data and erode trust.

The Growing Threat of Cybersecurity Risks in Fintech

Fintech companies handle vast amounts of sensitive data, making them attractive targets for cybercriminals. Data breaches, phishing scams, and sophisticated fraud schemes are just a few of the challenges these companies face. In 2023 alone, global financial institutions reported an alarming rise in ransomware attacks and credential theft, with the fintech sector among the hardest hit.

The stakes are high. A single breach can result in financial losses, regulatory penalties, and reputational damage. The digital-first nature of fintech also makes it vulnerable to evolving attack methods, as fraudsters leverage advanced tactics to exploit system vulnerabilities. For example, mobile payment systems, which are increasingly popular, are prime targets for man-in-the-middle attacks.

To address these risks, fintech companies must adopt a multi-pronged approach, combining cutting-edge technologies with robust consumer education.

Leveraging AI and Biometrics for Enhanced Security

Advanced technologies like artificial intelligence (AI) and biometrics are transforming how fintech companies protect sensitive data. These tools not only help in detecting fraud but also play a proactive role in preventing cyberattacks.

AI in Fraud Detection:

AI-powered systems analyse vast datasets to identify suspicious behaviour patterns. For instance, unusual transaction locations or atypical spending amounts can trigger automated alerts in real-time, stopping fraud before it escalates. AI also learns over time, adapting to new threat landscapes and improving detection accuracy. Companies investing in fintech software development often integrate AI to build systems capable of staying one step ahead of cybercriminals.

Biometrics in Authentication:

Biometrics, such as fingerprint scanning, facial recognition, and voice identification, offer an extra layer of security by replacing traditional passwords with unique identifiers. Unlike passwords, which can be stolen or guessed, biometric data is much harder to replicate. Many fintech apps now use biometric authentication to verify users quickly and securely.

However, implementing these technologies is not without challenges. AI systems require substantial upfront investment and ongoing refinement, while biometric solutions raise privacy concerns and need stringent data protection measures to prevent misuse.

Educating Consumers to Minimise Cyber Risks

Technology alone cannot solve all cybersecurity challenges. Human error remains a significant factor in many breaches, with consumers often falling victim to phishing scams or using weak passwords.

To tackle this, fintech companies must prioritise consumer education. By providing clear, accessible resources, they can help users understand and avoid common pitfalls. For instance, in-app tips about password strength or warnings about suspicious links can reduce vulnerabilities. A well-informed consumer base is a fintech company’s first line of defence against cyber threats.

Balancing Security and User Experience

While robust security measures are essential, they must not come at the cost of user experience. Consumers demand fast, frictionless interactions, and overly complex security protocols can drive them away.

Innovations like seamless multi-factor authentication (MFA) and secure application programming interfaces (APIs) offer solutions that prioritise both security and convenience. These tools allow users to access their accounts with minimal hassle while maintaining the highest levels of protection.

Cybersecurity in fintech is a critical issue that requires continuous innovation and collaboration. By leveraging AI and biometrics, educating consumers, and balancing security with usability, fintech companies can protect sensitive data while delivering the exceptional experiences users expect.

As the industry evolves, cybersecurity must remain a top priority. Companies that embrace these solutions and invest in fintech software development will not only safeguard their customers but also build long-term trust and resilience in the digital age.